The trend towards e-invoicing all across the globe is becoming increasingly important in recent years, and it is explained by fiscal and economic gains that could be expected for both governments and businesses. Here are the main expectations:

- Fighting fraud and reducing the VAT gap are the major expectations for governments, especially during these times of high inflation and the need for governments to lower expenses and increase tax income. With almost real-time reporting and the possibility for tax authorities to see both sides of transactions, it will allow cross-checking between purchases and sales, enabling a more effective combat against tax fraud.

- Monitoring the economic activity in the country will be possible for governments with the digitalization of invoices, which will help in managing economic policy more effectively.

- Reducing invoice processing costs will be expected for companies.

- Increasing efficiency, with faster invoice processing thanks to automation, real-time monitoring of the invoice life cycle status, an audit trail, and increased payments realization. This will result in less time spent on time-consuming administrative paperwork or spreadsheet activities, and the possibility to get payments done more rapidly, reducing disputes linked to late payments.

- Automating part of the VAT reporting process with pre-filled VAT reporting will help businesses save time and enable governments to have better control over business transactions.

‘E-invoicing’ is the replacement of paper invoices with structured electronic invoices that can be exchanged between economic operators and can also be automatically processed. An electronic invoice is an invoice issued, transmitted, and received in a dematerialized form. It necessarily includes a minimum set of data in a structured form, in a standard-based e-invoicing format with norms and semantic rules for each field. This differentiation sets it apart from “paper-based” invoices or ordinary PDFs. Importantly, an invoice sent via email as an Excel attachment, Word attachment, or as a PDF attachment is not considered an electronic invoice.

This possibility to send e-invoice on structured, syntactic and semantic format is the basis for Interoperability between the various systems.

The term ‘invoice channel’ refers to the method by which a digital invoice is transmitted from the sender to the receiver. There are various channels available, including:

- Direct Submission via Government Portals: In many countries, tax authorities provide secure online portals or platforms where businesses can directly upload and submit e-invoices. These portals are typically designed to accept e-invoices in a specific format or standardized schema.

- Interoperable E-Invoicing Networks: Some countries have established interoperable e-invoicing networks or platforms that connect businesses and tax authorities. These networks allow businesses to submit e-invoices in a standardized format, and tax authorities can access the data electronically. PEPPOL (Pan-European Public Procurement Online) is an example of such a network used in Europe.

- Integration with Accounting/ERP Software: Businesses often integrate their accounting or ERP (Enterprise Resource Planning) software with tax authority systems. This integration allows for the automatic submission of e-invoices and related transaction data directly to tax authorities in real-time or at specified intervals.

- Certified Service Providers: Some countries require businesses to use certified e-invoicing service providers. These providers ensure that e-invoices are generated, transmitted, and stored in compliance with local regulations. They often have direct connections to tax authorities for submission.

- Electronic Data Interchange (EDI): In regions where EDI standards are prevalent, businesses may use EDI to transmit e-invoices to tax authorities. EDI messages can be sent directly or through intermediaries that offer EDI services.

- Government-Provided Software: In certain countries, tax authorities offer free or subsidized e-invoicing software that businesses can use to create and submit e-invoices in the required format.”

Please proofread the following text. Correct spelling and grammar mistakes and make suggestions for improvement.

There are several e-invoicing standards in existence. The EU’s Directive 2014/55/EU on electronic invoicing in public procurement noted that “several global, national, regional, and proprietary standards exist; … none of them prevails, and most of them are not interoperable with one another.” Here is a non-exhaustive list:

- UBL (Universal Business Language): UBL is an XML-based standard for e-invoices widely used internationally. It is designed to be a universal format for electronic business documents, including invoices. UBL is recognized by many governments and organizations for its interoperability and adaptability.

- EDI (Electronic Data Interchange): EDI is an older but still widely used format for electronic invoicing, involving the structured exchange of data in a standardized format between computer systems. Various EDI standards exist, including EDIFACT and ANSI X12, used in different regions.

- PEPPOL (Pan-European Public Procurement Online): PEPPOL is a framework that facilitates electronic procurement processes in Europe, including specifications for e-invoices. Public sector organizations and their suppliers use it for cross-border e-invoicing within Europe.

- FatturaPA (Italian E-Invoicing Format): Italy has its own e-invoicing format called FatturaPA, mandated for business-to-government (B2G) and business-to-business (B2B) transactions. It is based on the UBL standard but has specific requirements for Italian taxation.

- ZUGFeRD (Central User Guide of the Forum for Electronic Invoicing in Germany): ZUGFeRD is a German e-invoicing standard that combines a PDF file with an XML file containing structured invoice data, making e-invoicing more accessible with both human-readable and machine-readable formats.

- Facturae (Spanish E-Invoicing Format): Spain uses the Facturae format for its electronic invoicing requirements, based on the UBL standard, and used for both B2G and B2B transactions.

- GSTN (Goods and Services Tax Network) in India: India has adopted a specific e-invoicing format under the GST regime. E-invoices in India are standardized in terms of data elements and are generated in JSON format.

- UBL PEPPOL BIS Billing 3.0: This is an extension of the UBL standard, commonly used within the PEPPOL network for cross-border e-invoicing in Europe.

- XML with Country-Specific Extensions: Many countries adopt XML-based formats with country-specific extensions to meet their unique legal and tax requirements. These extensions often include additional data fields for tax details and other regulatory information.

The digitalization of invoicing has an impact on daily business operations, financial systems, master data governance, and the work of individuals. To understand these impacts, an initial analysis of the existing situation is essential during implementation. It helps identify non-standard processes and specific system information settings. Having a clear overview of each transactional invoicing scenario is crucial for the successful digitalization of invoices.

This can be achieved through scoping investigations, which help address the main challenges for the taxpayer, including data, processes, and technology. Project scoping activities aim to determine the source of invoice data, the availability of required data, transaction posting procedures, the type of invoicing document, the invoicing process, the stakeholders involved, and the settings in the ERP system for generating invoices.

Having a clear overview of existing scenarios ensures that operations remain uninterrupted and compliant with tax regulations.

Implementing e-invoicing in a company, regardless of its size, requires budgeting and planning. It involves multiple stakeholders and resources to ensure success, including a mix of functional and technical teams, such as business process owners, tax representatives, legal experts, and IT teams.

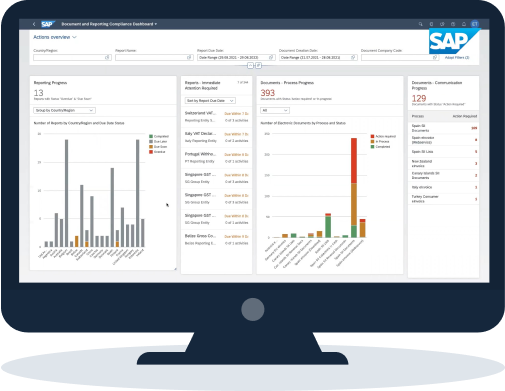

When seeking a solution, it’s advisable to consider an ERP system that offers a comprehensive global e-invoicing solution, such as SAP Document and Reporting Compliance (SAP DRC). SAP DRC is fully integrated into SAP ERP, compliant with various country regulations, it covers standard scenarios, and can be customized to address specific use cases requiring analysis.

E-invoicing deployment around the world varies significantly. Latin American countries, starting with Brazil, pioneered the use of mandated clearance models, where invoices must be cleared by tax authorities before issuance. In Europe, Italy, and Spain have enforced e-invoicing for B2G, B2B, and B2C transactions, with real-time reporting and platforms like Sistema di Interscambio (SdI). Several Asian countries have adopted PEPPOL standards and are increasingly moving toward making e-invoicing mandatory. However, there is no universal global standard, and deployment strategies vary widely based on regional legal requirements, transaction types, and objectives for compliance, making e-invoicing an evolving landscape across the globe.

CTC models are country-specific and vary in detailed design and implementation. They can be either centralized, requiring suppliers to send e-invoices through a centralized tax authority system, or decentralized, allowing suppliers to e-invoice buyers directly while simultaneously sending reporting data to the tax authority. These models can be grouped into broad categories based on their typical features:

- Interoperability Model

- Real-time Invoice Reporting Model

- Clearance Model

- Centralized Exchange Model

- DCTCE (Dynamic Control Tax Collection Environment)

For an overview of the transaction flow, refer to the pictogram below.

Companies that are not compliant with the e-invoicing mandate may face fines and penalties, experience delays in payment processing, disrupt the supply chain, and damage their reputation as they may be perceived as unprofessional or unreliable. Moreover, non-compliant e-invoices can lead to trust issues with tax authorities, potentially resulting in audits or investigations. Such invoices can also lead to disputes with suppliers or customers, potentially harming business relationships.