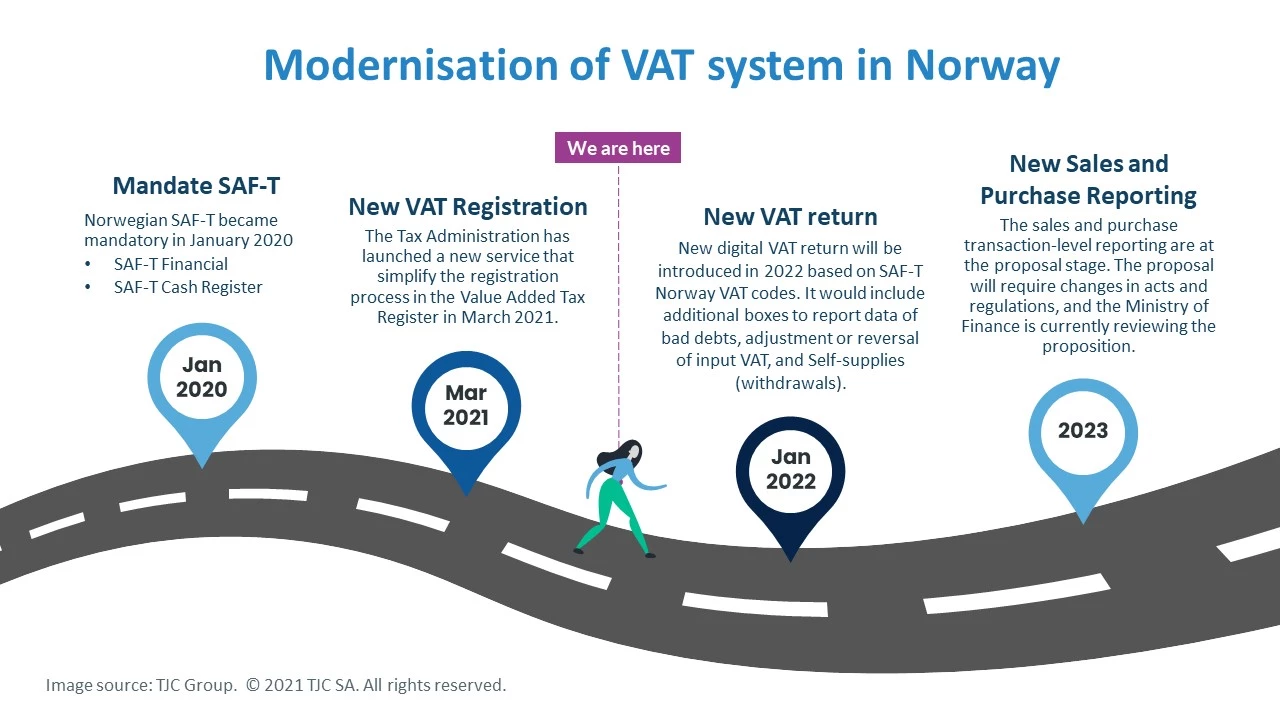

Nous pouvons nous attendre à ce qu’une série de nouveaux processus de conformité numérique soient introduits au cours des prochaines années, alors que les régulateurs de toute l’Europe agissent rapidement pour réduire l’écart fiscal. La Norvège est la dernière d’une longue lignée, avec des déclarations de TVA améliorées basées sur les codes SAF-T nécessitant des déclarations détaillées.

Obligatoire au 1er janvier 2022, voici à quoi s’attendre et comment se préparer.

1. Vérifier l’état de préparation interne et la disponibilité des ressources

Les équipes fiscales et informatiques internes doivent travailler ensemble pour comprendre la situation actuelle et planifier l’avenir. Les nouvelles règles de déclaration de données SAF-T Norway pour les déclarations de TVA créeront des problèmes de conformité immédiats.

Préparez-vous en cartographiant les ressources, les processus métier et l’infrastructure existants par rapport à ce qui sera nécessaire à partir du 1er janvier 2022. Cela comprend la réalisation de trois vérifications clés :

- Assurez-vous que les données pertinentes SAF-T sont disponibles dans votre système SAP et peuvent être converties au format XML requis ;

- Évaluer la qualité des données de base fiscales et des données transactionnelles pour les ventes et les achats ;

- Cartographiez les comptes et les codes de TVA à inclure dans les futurs rapports SAF-T.

2. Évaluer les solutions SAF-T potentielles

L’automatisation du traitement numérique des déclarations de TVA avec un logiciel certifié permet un transfert de données en temps réel entre votre solution SAP et le portail de dépôt de l’administration fiscale norvégienne, Altinn . Cela permet d’économiser du temps, des ressources et de minimiser les risques d’erreur humaine. Les avantages des systèmes synchrones automatisés sont importants, mais ils nécessitent que les données soumises soient correctes du premier coup et correctement formatées. Toute flexibilité pour effectuer des corrections manuelles ou des consolidations avant la soumission est réduite lorsque vous travaillez en temps réel.

Si vous envisagez une solution SAF-T pour automatiser les processus d’extraction et de gestion des données, assurez-vous qu’elle peut intégrer indépendamment les données de plusieurs systèmes sources dans un seul rapport. Sans que votre service informatique ne soit impliqué.

Les règles de conformité SAF-T sont en vigueur dans toute l’Europe et les entreprises multinationales ont besoin de solutions évolutives et extensibles à l’échelle internationale pour répondre aux exigences spécifiques de l’industrie.

Il faut du temps pour trouver les bons outils, alors commencez le processus d’évaluation des différentes solutions SAF-T dès que possible. Commencez par une solution SAP standard et évaluez dans quelle mesure elle s’adapte à vos processus métier actuels. Posez-vous ces questions :

- Dans quelle mesure est-il adapté à votre secteur d’activité ?

- A-t-il des limites ?

- Est-il facilement personnalisable ?

- Le développement ultérieur du logiciel peut-il être géré en interne ou sera-t-il confié à un spécialiste ?

Si le temps est compté et les ressources limitées, réfléchissez à la manière dont une solution SAF-T alternative, par exemple une solution « prête pour le régulateur » telle que SAF-T Norway de TJC, atteindra vos objectifs. Il peut vous aider à extraire les données correctes rapidement et avec précision, ce qui vous permet d’économiser du temps et des ressources. Cela signifie plus de temps disponible à consacrer à l’amélioration des opérations quotidiennes et des tâches stratégiques.

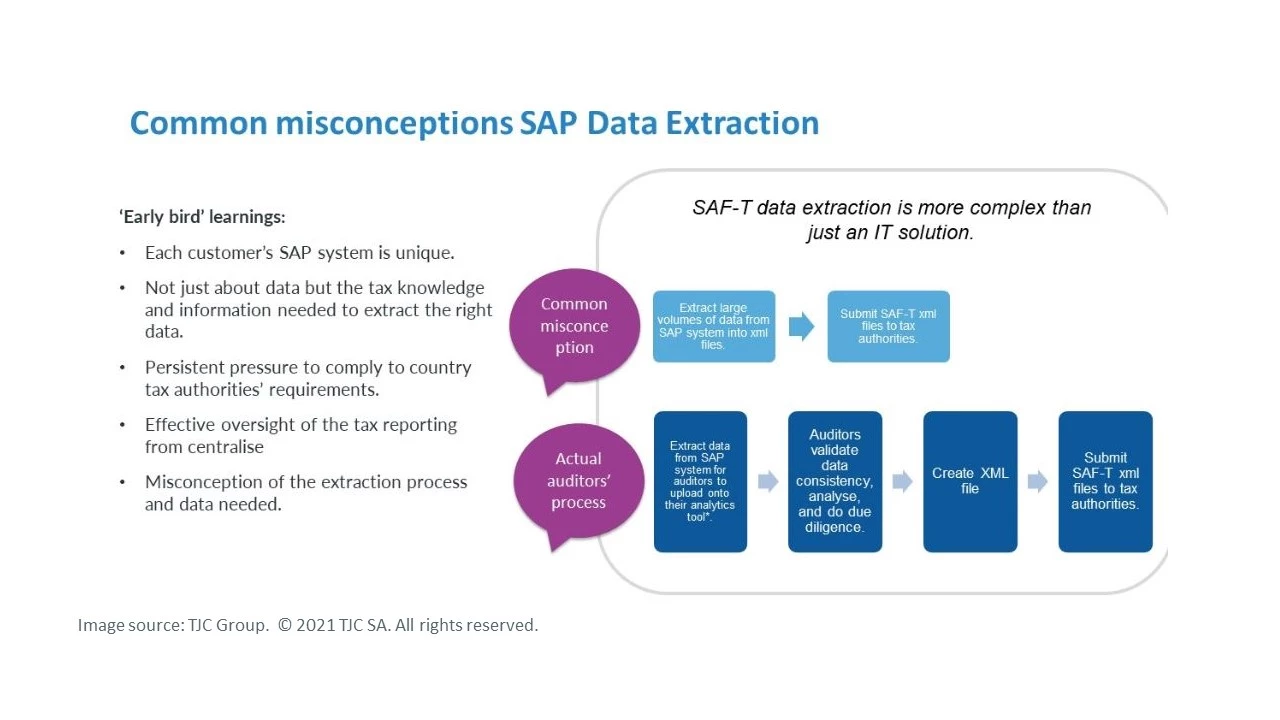

3. Ne sous-estimez pas la complexité de la validation et de la réconciliation des fichiers SAF-T

La conformité SAF-T va bien au-delà de la simple installation d’une solution logicielle. L’utilisation efficace des outils SAF-T ne se limite pas à une extraction automatisée des données. Cela implique d’avoir la bonne connaissance des régimes fiscaux locaux, de comprendre les subtilités des réglementations et les informations nécessaires, ainsi que les compétences nécessaires pour extraire les bonnes données.

La cohérence des données est essentielle à des fins de conformité et c’est pourquoi la validation et la réconciliation des fichiers SAF-T sont cruciales. La validation technique par rapport au schéma approuvé est indispensable pour garantir que les données peuvent être extraites dans un format acceptable pour être soumises aux autorités fiscales. En travaillant en étroite collaboration avec un auditeur et un spécialiste B2G , vous serez en mesure de valider le contenu SAF-T, de contrôler les soldes et de rapprocher les données SAF-T avec les rapports SAP existants tels que le solde du grand livre ou les soldes client/fournisseur.

Bien que les déclarations SAF-T Norvège et la nouvelle déclaration de TVA électronique soient indépendantes des régimes des autres pays, elles sont basées sur les mêmes codes de TVA standard et doivent être cohérentes.

Collecter et rapporter les bonnes informations pour la conformité SAF-T peut être difficile et toutes les organisations doivent avoir mis en place des contrôles pour le reporting des transactions en temps réel à partir de SAP. La dernière modernisation de la TVA introduite pour la Norvège n’est que le début de l’adoption massive par le pays de la conformité fiscale numérique, les régulateurs cherchant à éliminer la non-conformité et à minimiser les insuffisances de reçus fiscaux. Nous pouvons nous attendre à ce que beaucoup d’autres suivent le mouvement.

Pour obtenir une compréhension détaillée des exigences SAF-T en Norvège, regardez ce webinaire à la demande “Get ready for SAF-T Norway mandate and Tax Compliance in Europe”, organisé par SBN Norge, le groupe d’utilisateurs SAP norvégiens en avril 2022 .