Value-added tax (VAT) is a major source of revenue for EU member states, estimated at around 20% of total government revenue. As a result, VAT is also an indirect source of funds for the EU budget. In December 2022, the EU Commission proposed reforms for the bloc’s VAT system called VAT in the Digital Age (ViDA) to improve VAT collection. The ViDA initiative stems from a 2020 action plan from the EU Commission for fair and simple taxation.

Overall, the VAT in the Digital Age proposal is intended to modernize the VAT system for cross-border e-commerce transactions and to simplify VAT compliance for businesses. It is part of the EU’s broader efforts to create a digital single market where businesses and consumers can trade more efficiently and effectively across the EU.

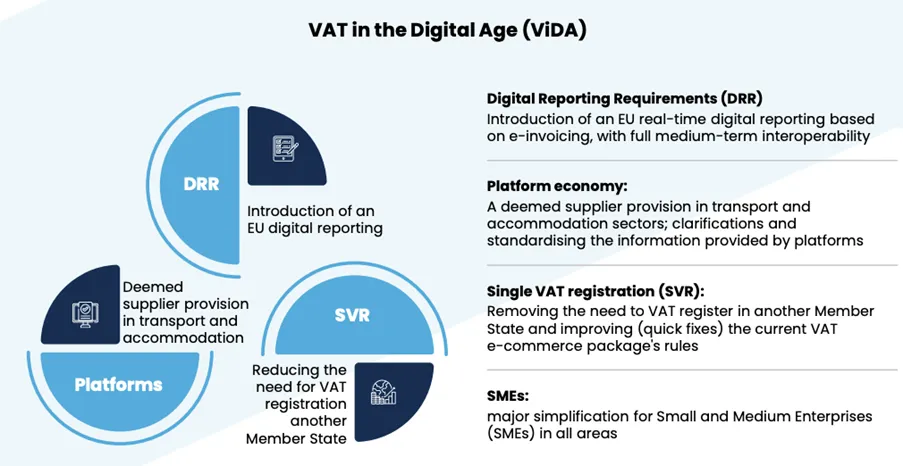

The ViDA proposals revolve around three main pillars:

- Digital Reporting Requirements (DRR) – Harmonises VAT reporting obligations by introducing EU real-time digital reporting based on e-invoicing. It will impose e-invoicing for cross-border transactions with full medium-term interoperability.

- The platform economy – Updating the VAT rules applicable to the platform economy in short-term accommodation and passenger transport sectors. The platform will be deemed responsible for collecting VAT when service providers do not, and for remitting this VAT to tax authorities.

- Single VAT Registration (SVR) – Removing the need for multiple VAT registrations in other Member States by introducing Single VAT Registration (SVR) and improving the current VAT e-commerce package’s rules for businesses selling to consumers across the EU. Expands the existing One Stop Shop (OSS) and Import One Stop Shop (IOSS) schemes for certain transactions and introduces the mandatory reverse charge mechanism.

Why is the EU implementing a VAT reform?

The VAT in the Digital Age reforms were proposed in response to the rapid growth of e-commerce and cross-border online sales, which have created new challenges for the current VAT system in the EU. The EU recognised that the current VAT rules for cross-border e-commerce transactions were complex and fragmented, with different VAT rates and thresholds in each member state, which created a burden for businesses and made it difficult to ensure that VAT was paid where consumption occurred.

In addition, the EU was concerned about the impact of the VAT exemption for low-value imports on EU businesses. It created an uneven playing field for EU and non-EU businesses selling to EU customers. Non-EU companies were able to sell goods to EU customers without paying VAT, giving them a price advantage over EU businesses. The ViDA reforms aim to simplify the VAT rules for cross-border e-commerce and to create a level playing field for EU and non-EU businesses while ensuring that VAT is paid where consumption occurs. The reforms are also part of the EU’s broader efforts to create a digital single market where businesses and consumers can trade more efficiently and effectively across the EU. By modernising the VAT system for cross-border e-commerce transactions, the EU hopes to support the growth of the digital economy and make it easier for businesses to trade online across borders.

ViDA can also address the “VAT Gap”

Moreover, the digitalisation of VAT compliance can help to increase tax revenues. Improving compliance can help to increase tax revenue, which is a more politically palatable approach to increasing realised taxes than raising VAT rates.

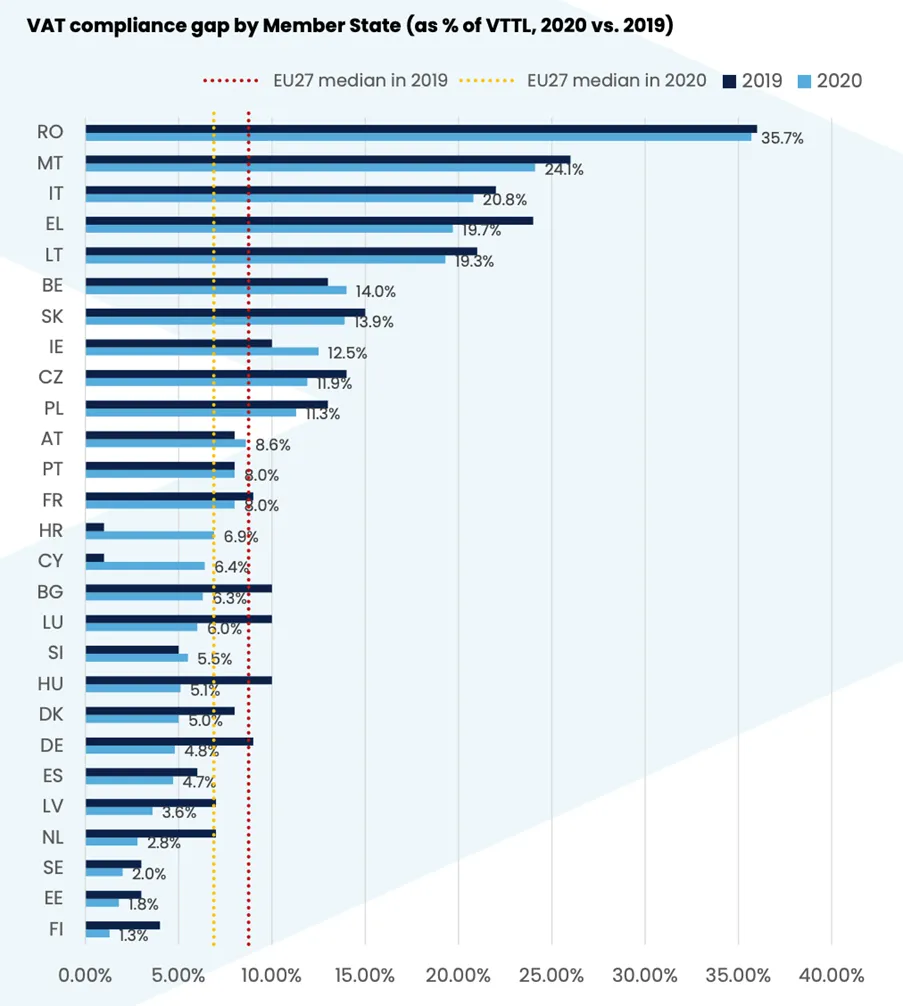

In 2020, the EU lost €93 billion or 9.1% of expected VAT revenues. This represented an improvement of more than €30 billion compared to 2019, thanks to improved VAT compliance. However, the significant remaining shortfall in VAT revenues suggests a significant opportunity for ViDA to impact tax compliance and fairness positively.

The VAT gap estimates the extent of VAT revenue loss due to tax fraud, tax evasion, tax avoidance and optimisation practices, bankruptcies, financial insolvencies, miscalculations, and administrative errors. In 2020, Romania recorded the highest VAT compliance gap, with 35.7% of VAT revenues, followed by Malta (24.1%) and Italy (20.8%). The smallest gaps were observed in Finland (1.3%), Estonia (1.8%), and Sweden (2.0%). In absolute terms, the highest VAT compliance gaps were recorded in Italy (€26.2 billion) and France (€14 billion).

What are some of the key aspects of the proposed changes?

- Proposal for Digital Reporting Requirements (DRR) and e-invoicing: The DRR will drive e-invoicing adoption in the EU. Shifting to e-invoicing will help member states recover lost VAT revenue of up to €11 billion annually for the next ten years, with more real-time reporting and granular data. Businesses will save €4.1 billion a year in compliance costs. However, the European Commission opted for partial harmonisation of digital reporting, meaning that e-invoicing and digital reporting will become mandatory for intra-EU transactions but remain optional for domestic transactions. This might be burdensome for businesses in countries where e-invoicing is not required for domestic transactions to separate cross-border and other flows. Applying DRR for all taxpayers with no thresholds for exceptions will be challenging for micro businesses because their inclusion would significantly increase compliance costs, with limited positive effects on VAT revenue and the fight against VAT fraud.

· A new definition of “electronic invoices” as of 1st January 2024: Only an invoice that has been issued, transmitted and received in a structured electronic format which allows for automatic and electronic processing, will be accepted as an electronic invoice. This means that a PDF will no longer be considered an electronic invoice.

- Mandatory e-invoicing will be possible without EU approval from 1st January 2024: Member States can introduce mandatory e-invoicing without derogation from the EU from this date. Member States shall allow for the issuance of electronic invoices which comply with the European e-invoicing standard EN16931. The requirement of customer acceptance for e-invoicing will be abolished. It will no longer be possible to apply the e-invoicing pre-clearance model. Therefore businesses will not be obliged to send electronic invoices to tax authorities for approval. Member States adopting these systems will need to converge to the new rules by 1st January 2028, for instance in Italy and Poland.

- E-invoicing will become the norm as of 1st January 2028: Electronic invoices will become the default system for issuing invoices.

- Intra-EU near real-time digital reporting requirement based on e-invoicing as of 1st January 2028: This e-invoicing obligation will facilitate a digital reporting requirement (DRR) which will replace the current recapitulative statements (EC Sales Lists) for B2B intra-EU transactions. The relevant invoice data will need to be reported to tax authorities within two working days after issuing the invoice including additional data elements such as bank account, payment due date and corrected invoice number for the case of corrective invoices. The tax authorities will share this data with other Member States by transmitting it to the central VIES database, where the data will be available for analysis for five years.

- Voluntary digital reporting requirements for domestic transactions: Member States are free to introduce digital reporting requirements for domestic transactions and must ensure this conforms to the EU DRR. Member States with digital reporting systems must align them to the new standard by 2028 at the latest.

What are the next steps?

The measures announced by the EU Commission in December 2022 were part of a proposal that still needs to pass through the legislative process before implementation. The legislative proposal will be submitted for agreement to the European Council and for consultation with the European Parliament and the Economic and Social Committee.

After announcing the proposed VAT reforms, the Commission announced a public consultation window, which will run through to April 3, 2023. Feedback received will reportedly be presented to the European Parliament and Council to support legislative debate.

While VAT in the Digital Age has yet to be implemented, many businesses operating within the EU will have begun to prepare for the proposed changes, especially regarding the necessary system updates for standardised e-invoicing. In addition, implementing the simplification regime (OSS) may allow businesses to simplify their reporting obligations.

The digitalisation of EU tax legislation is happening now and real-time reporting is here to stay. Learn more about TJC Group SAP Tax Compliance software solutions and Business to Government consulting services at: https://www.tjc-group.com/business-to-government/

If you need further advice to respond to the the ever-expanding maze of SAP Tax compliance requirements, to get the data that is needed from SAP Systems and submit it in the right format, at TJC Group we have a team of expert to support your teams. Get in touch at www.tjc-group.com/contact.