Written by: Patchanok Kluabkaew

Are you doubtful that your FEC file is compliant? If the answer is yes, you’re not alone. Based on our experience of supporting customers in France with FEC (Fichier des Écritures Comptables) creation, many are not confident with their FEC validation process and this is especially true of IT departments.

This article outlines useful tips to remedy the situation and protect your company’s reputation from the risks of FEC non-compliance.

When talking about FEC validation, the “Test Compta Demat” may come to mind. This free FEC testing tool proposed by the French tax administration provides a basic verification of file structure. In fact, non-compliance and inconsistencies are more usually found within the FEC file than the structure. For example, common issues include account numbers not being in line with the Plan Comptable Général (PCG), unbalanced carry forward values and incorrect G/L account balances compared to SAP account balance reports.

Another common reason for non-compliance stems from the tools or software used to generate FEC files. A reliable solution can reduce the risks but finding one you can trust can be difficult. This is because French tax administrators will refuse to certify FEC solutions even though they may be SAP-certified, as is the case with TJC Group’s solution.

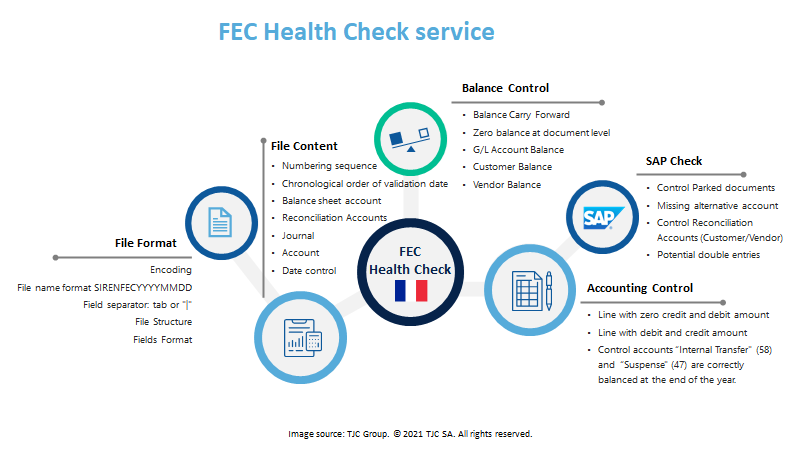

Configuration or master and transactional data in your SAP system could be the cause of inconsistencies. To address this, we embedded pre-defined validation rules into our new version FEC, to help customers accelerate and automate the validation process.

Best practice guidance: 5 tips for FEC validation

TJC Group recommends verifying FEC data for the following five topics before sending it to external auditors or submitting FEC files to tax administrators.

1. File Format

- Encoding

Characters used should belong to one of the following: ASCII-based standard character encodings, ISO 8859-15 standard or Unicode character set, ISO/IEC 10646 standard, type UTF-8.

- File name format

File name format is SIRENFECYYYYMMDD where:

- SIREN is the company Siren number

- YYYYMMDD is closing date of the fiscal year, for example 20181231.

- Field separator

Field separator must be tab or “|”.

- Fields Format

- Numeric fields should be decimal with right-justified and left-leading zeros. The decimal separator character is ‘,’ (comma). The sign position for amount fields should be represented to the left of a numeral.

- Alphanumeric fields are expressed as a fixed length and thus, completed on the right by ” “.

- Date field is expressed in YYYYMMDD format.

- File Structure

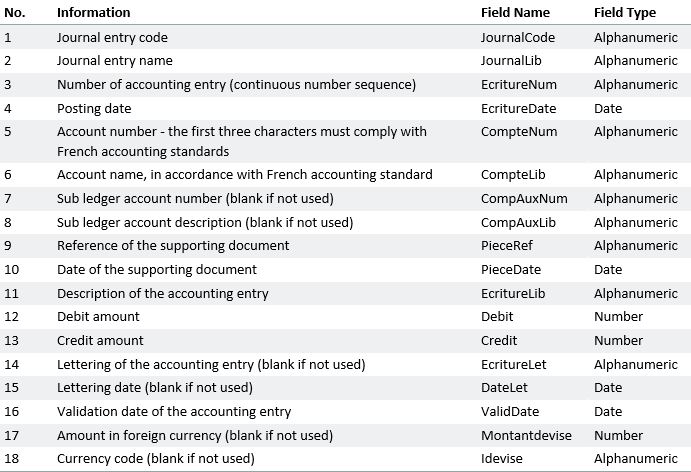

Ensure the FEC file contains the required 18 accounting entry fields of information as depicted in the table below. Part 1 comprises carry forward balance postings and Part 2 is general ledger entries.

2. File Content

- Numbering Sequence

When using a generic validation tool, you will always receive an error message about the numbering sequence of document numbers (EcritureNum). TJC is regularly asked about this by customers because SAP document number ranges are set up per document type. As a result it is necessary to check if all accounting documents are reported in the FEC and to establish whether some documents are missing. For instance, are they CO allocation documents? Are parked documents pending in the system?

- Chronological order of validation date

Have any documents been posted in advance? Is the posting date later than the entry date?

- Balance sheet account

Balance sheet accounts in the carry forward balance section must be class 1 – 5 accounts. Account classes 6 and 7 are not subject by their origin to a carry forward balance. In particular, class 8 accounts (designated to satisfy the information requirements for papers – see article 434-3 of the accounts chart) and class 9 (analytic exploitation accounts) are off balance and not requested in the FEC.

- Reconciliation accounts (compte auxiliaire)

The sub ledger account number and name (customer/vendor) should be reported for reconciliation accounts.

- G/L Account (Le numéro de compte)

The first three characters must comply with the French accounting standard (PCG). For the companies who use local Chart of Accounts please ensure you maintain alternative accounts in the G/L master correctly.

- Date control

Be careful with the mapping of date fields.

EcritureDate should be later than or the same date as PieceDate;

ValidDate should be later than or the same date as PieceDate;

DateLet should be later than or the same date as PieceDate;

DateLet should be later than or the same date as EcritureDate.

3. Balance Control

- Balance Carry Forward

We recommend extracting the carry forward balance data from SAP transaction S_ALR_87012277 and reconciling it with the carry forward balance in the FEC file.

In some cases, the accounts of classes 8 and 9 can be found in the carry forward balance section. Ensure a proper alternative account is defined in the GL master. In the accounts chart, the accounts 8xxxx and 9xxxx are not included in the elaborated balance sheet and should not impact postings at the beginning of the fiscal year (carry forward balance) whose single purpose is to find the balances of these accounts (accounts of balance sheets) in the journal.

If somehow the accounts of classes 8 and 9 had an impact on the balance sheet, an accounting and tax analysis would be required to arbitrate the need to integrate some or all of the 8xxxx / 9xxxx entries. If this occurs, it is important to discuss it with your external auditor or tax advisor before submitting the FEC to tax administrators.

- G/L Account balance

We suggest extracting the G/L balance using SAP transaction S_ALR_87012277 in your ECC6 or S/4HANA system and reconciling it with the G/L balance in the FEC file.

- Customer Balance

Extract customer balances using SAP transaction S_ALR_87012172 in your ECC6 or S/4HANA system and reconcile them with customer balances in the FEC file.

- Vendor Balance

Extract vendor balances using SAP transaction S_ALR_87012082 in your ECC6 or S/4HANA system and reconcile them with vendor balances in the FEC file.

- Zero balance at document level

To ensure all line items from accounting documents are reported in the FEC file, check if the balance at document level is zero.

4. SAP master data and transactional data check

- Control Parked documents

Parked documents lead to problems placing accounting document numbers into chronological order of. Check that pending parked documents are not present in the reporting period.

- Missing alternative account

For companies that use local Chart of Accounts, alternative accounts for the French GL should be defined. Missing alternative accounts are one of the most common mistakes on GL master data and lead to improper FEC reporting or missing data.

- Control reconciliation accounts (customer/vendor)

For reconciliation accounts, data should be reported at customer/vendor level for both the carry forward balance section and the accounting entries section.

5. Accounting control

- Lines with zero debit and credit amounts

- Lines with debit and credit amounts

- Control accounts “Internal Transfer” (58) and “Suspense” (47) are correctly balanced at the end of the year.

Assess the best software solution to generate the FEC file

It is best practice to extract and validate FEC files regularly. Do not wait until tax audit time to generate the FEC file, it will not leave enough time to validate, correct data, fine-tune the extraction tool and provide justification reports. Work closely with your auditor to understand and prepare for the compliant file and identify further data analytics opportunities with the file extracted

As you’re probably aware of, there are some prerequisites to implement before Tax and Audit teams can actually create the FEC file in DART. You might find the article “How to generate the Fichier des Écritures Comptables (FEC) in a few words?” useful if you’re looking for guidance on these prerequisites and the steps to be taken to generate the FEC using the DART tool.

Sources of information:

- Article A47 A-1 of the French Tax regulation

- “Test Compta Demat” FEC testing tool

https://www.economie.gouv.fr/dgfip/outil-test-des-fichiers-des-ecritures-comptables-fec

- FEC solution by TJC

https://www.tjc-group.com/products/fec

Patchanok Kluabkaew is a Senior SAP Consultant for Tax and Audit at TJC Group. She has more than 20 years of experience in SAP covering greenfield and brownfield implementation as well as roll-out in various industries. Patchanok leverages her SAP knowledge in FI, SD, MM, technical background and project management to help clients to tackle Tax Compliance challenges and streamline their tax and audit processes.

Connect with Patchanok on LinkedIn.