Author: Priyasha Purkayastha, Global Content Manager, TJC Group | Co-author: Satish Bhattrai, SAP B2G Consultant, TJC Group

E-invoicing in Germany has been on the rise ever since 2020. The benefits that electronic invoicing offers organisations are par excellence, helping not just with error-free invoices but also with sustainability and more. However, each country has its own set of rules and regulations that organisations have to take care of. In this blog, we talk about the important points that you must know about electronic invoicing in Germany. Read on!

Table of contents

- Introduction

- Germany to embark on its domestic B2B e-invoicing journey

- Timeline for e-invoicing in Germany for domestic B2B

- Supporting standards for e-invoicing in Germany for B2B

- Leveraging SAP Document and Reporting Compliance (SAP DRC) for e-invoicing in Germany

- Join hands with TJC Group for your SAP DRC implementation

Introduction

In simple language, e-invoicing aims to replace the traditional method of sending or receiving invoices with a standard electronic format or digital method. This method of exchanging invoices between buyer and seller (or suppliers) comes with numerous advantages for both parties. Additionally, it offers excellent benefits to tax authorities and governments worldwide.

Bear in mind that the government of the country is the entity that is responsible for making decisions related to the implementation of new, more advanced solutions. In this case, it is the execution of electronic invoicing and reporting. Of course, along with the advantages that the solution offers, there are many nuances that you have to ensure. For example, there are different sectors of invoicing, like B2B, B2G, or even B2C, for that matter. With electronic invoicing becoming mandatory, several governments have set their deadlines for the coming years. In this blog, we shed our focus on Germany, which is in the process of adapting electronic invoicing for its B2B sector.

Germany to embark on its domestic B2B e-invoicing journey

E-invoicing in Germany started in 2020 with the primary focus on the B2G sector. The country adopted this solution in a phased manner, where the implementation was done state-wise. Going a step ahead for a more sustainable and proficient future, the German government shifted its focus to adapting the same for its domestic B2B sector. As a matter of fact, domestic B2B electronic invoicing in Germany received a go-ahead from EC, thereby solidifying its grounds to introduce compulsory e-invoicing in the business-to-business sector. All in all, similar to its B2G electronic invoicing plan, Germany’s plan to implement invoicing in domestic B2B is also in a phased manner.

Timeline for e-invoicing in Germany for domestic B2B

January 2025

Buyers should receive invoices issued as per EN 16931*, which is the European Norm. Along with this, suppliers can issue invoices in other formats like paper, PDF, and so on. As of now, there is no prescribed e-invoicing channel for transfer; however, authorities will not be involved in the invoice flow.

January 2027

By January 2027, suppliers having a turnover of more than EURO 800K must strictly adhere to issuing e-invoices. Again, as per the EN 16931 norm, buyers will receive electronic invoices. Adding to this, buyers can still receive invoices in EDI formats that are not as per the EN 16931 standard.

January 2028

January of 2028 is going to be extremely interesting for e-invoicing in Germany. By then, all e-invoices pertaining to the domestic B2B sector must be as per the EN 16931 standard. Bear in mind that by January 2028, organisations (suppliers, buyers, etc.) cannot use e-invoices in any other formats; as a matter of fact, even EDI invoices that do not adhere to EN 16931 will be invalid.

* EN 169311 is a European Norm, or a semantic model prescribed by the EU for the electronic format of invoices.

Supporting standards for e-invoicing in Germany for B2B

An overlooked factor in the area of electronic invoices across the world is the standard format used. For e-invoicing in Germany, two standards have gotten a nod, namely:

- XRechnung, also known as UBL 2.1 (PEPPOL network).

- ZUGFeRD

XRechnung: A brief overview

XRechnung is an e-invoicing standard for public contracting authorities, implementing the EU Directive 2014/55 in Germany. Koordinierungsstelle für IT-Standards, or the Coordination Office for IT Standards (KoSIT), maintains and develops XRechnung on behalf of the IT Planning Council. Moreover, the KoSIT coordinates and ensures the development of XRechnung from time to time with assistance from federal government experts, state and municipal experts, and others.

ZUGFeRD: A quick glance at it

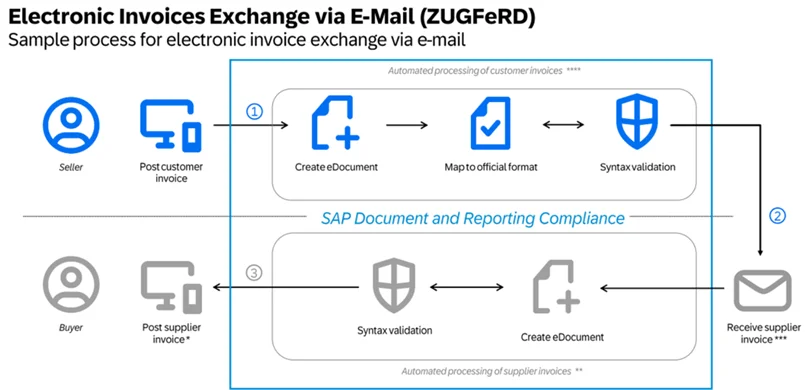

This is another standard for electronic invoicing in Germany, commonly known as ZUGFeRD. In the bigger picture, it is called the Central User Guide of the Forum for Electronic Invoicing in Germany. In this standard, one can combine a PDF file with an XML file, and it can be emailed directly to the respective parties. ZUGFeRD contains structured invoice data that makes it both easily human-readable and machine-readable.

Leveraging SAP Document and Reporting Compliance (SAP DRC) for e-invoicing in Germany

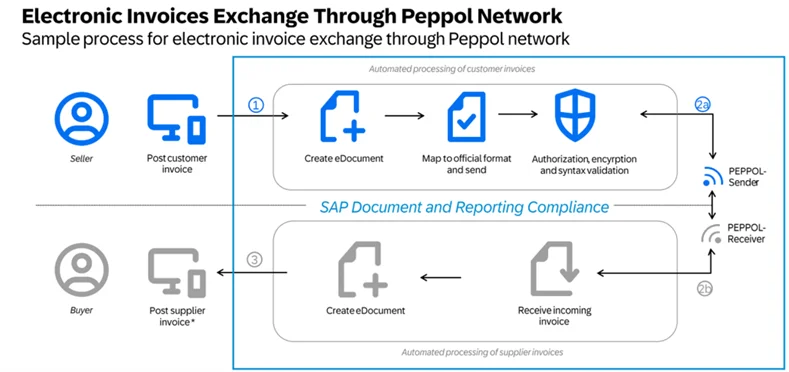

SAP DRC offers a streamlined, robust, and easy solution to implement e-invoicing in SAP systems. Organisations and associated stakeholders can leverage this easy-to-implement solution and gain its benefits to a greater extent. With SAP Document and Reporting Compliance, organisations in Germany can typically opt for two types: one through the PEPPOL network and another via email exchange, i.e. ZUGFeRD.

Some insights into SAP DRC’s eDocument Cockpit

As a matter of fact, the most crucial feature of this e-invoicing solution is the ease with which users can use it on a daily basis to submit e-invoices; especially, in the functionality called eDocument Cockpit. For the unversed, eDocument Cockpit is a platform in the SAP system where one can view, submit, cancel, delete, resubmit, and even view the XML files. This can be accessed in SAP systems via transaction code or through Fiori apps. Therefore, functions like real-time monitoring and correction are possible.

Additionally, e-invoices are created and will be present in the cockpit as soon as the invoices are created in the SAP system. As a matter of fact, this makes SAP DRC hassle-free for users as the creation of e-invoices is automatic. Users do not need to worry about more technical know-how like mapping, authorisation, encryption, and syntax validation. All of these are taken care of by the standard SAP solution after implementation. That being said, submission of e-invoices can again be automated by using the background jobs.

For e-invoicing in Germany, the diagrams below depict the basic flow of data and information for PEPPOL and ZUGFeRD. The basic flow suggests that once the invoices are posted, they appear in the eDocument cockpit. Then, it reaches the government portal via the relevant network once the e-invoices are submitted.

Consequently, keep in mind that in SAP S/4 HANA Public Cloud Edition, only XML can be sent as an email attachment. However, in SAP ERP and SAP S/4 HANA, the PDF/A-3 can be sent as an email attachment.

Join hands with TJC Group for your SAP DRC implementation

SAP DRC is one of the most sought-after solutions for e-invoicing and reporting. However, you would want a helping hand to help you experience a smooth process, wouldn’t you? We, at TJC Group, extend our hands to organisations that are on their way to implementing electronic invoicing. Our experts come with decades of experience and vast SAP knowledge that makes the implementation much more streamlined and smoother. Furthermore, we also help manage data effectively, adding more comfort and efficiency to your business operations.

Whether you want to implement e-invoicing in Germany, Malaysia, or any other country, TJC Group is here to help. Contact us now to learn more!