Author: Priyasha Purkayastha, Global Content Manager, TJC Group

Technical expert: Patchanok K, B2G Team Lead, TJC Group

Table of contents

- Driving force behind e-invoicing and e-reporting globally

- Deploying e-invoicing: How is it done across the world?

- Formats of e-invoicing and e-reporting to know of

- Electronic Data Interchange (EDI)

- Pan-European Public Procurement Online (PEPPOL)

- Universal Business Language (UBL)

- FatturaPA

- Goods and Service Tax Network (GSTN)

- ZUGFeRD

- Facturae

- Factur-X

- UN/CEFACT Cross-Industry Invoice (CII)

- UBL PEPPOL BIS Billing 3.0

- XML with country-specific extensions

- Implementing e-invoicing and e-reporting into your business

Driving force behind e-invoicing and e-reporting globally

Across the world, governments are adopting e-invoicing and e-reporting mandates. The drastically evolving tax compliance and reporting landscape contributes to this. Additionally, more stringent reporting and invoicing requirements are being implemented on international businesses, thereby leading to increased global regulatory pressure. Along with this, there is a transition in the authorities as well. They are adopting a more strategic, commercial, and digital approach, making things much smoother and streamlined. In fact, the digital era has truly played a positive role in the tax and regulatory landscape.

All in all, e-invoicing and e-reporting have helped streamline the process from organisations to tax authorities. However, why is this digital solution so emphasised globally? The answer is simple – to reduce the gaps that occur during the invoicing and reporting process. Unfortunately, these gaps occur due to several reasons, such as poor administration, corporate insolvency and bankruptcy, fraud and tax evasion, and so on. Interestingly, e-invoicing offers the ultimate approach to tackling these gaps because it requires invoices to be pre-approved by the tax administration before being issued to the customers. In turn, this helps eliminate potential revenue leaks as well as reduce VAT gaps.

Deploying e-invoicing: How is it done across the world?

While governments are making it a mandate to implement electronic invoicing and reporting globally, here’s a quick glance at how this digital approach has been implemented in a few countries –

Brazil

First mandated in Brazil in 2008, e-invoicing came into the picture with the introduction of a clearance electronic model. In this model, the country’s tax authorities were first to receive and clear the invoices before the supplier could issue them. As the years went by, this clearance model was later adopted by most Latin American (LATAM) countries.

Italy

In Europe, Italy was the first country to mandate e-invoicing and e-reporting. Mandating electronic invoices for B2G transactions in 2014, the government later went ahead and implemented the same for B2B and B2C transactions in 2019, using the Sistema di Interscambio (SDI) platform.

Spain

Coming to Spain, the country introduced the SII live invoice reporting in 2017, which required the electronic provision of relevant VAT data for issued and received invoices to the Spanish Tax Agency, AEAT. In fact, the SII qualifies as a Continuous Transaction Control system. Moreover, mandatory usage of e-invoices for large taxpayers is set to come into effect by 2025, while for others, the expected timeline is 2026.

Romania

In Romania, the government has mandated e-invoicing for B2G ever since July 01, 2022. The e-invoicing process is done using the RO eFactură protocol. For others, such as large corporations, electronic invoicing was scheduled to be implemented from January 2024.

Poland

The country introduced structured invoices, known as KSEF, making it mandatory for taxpayers. Initially, it was to be implemented in July 2024; however, as per the latest developments, the mandate has been delayed to February 2026. Read the full update here: https://www.tjc-group.com/blogs/new-date-for-poland-mandatory-b2b-e-invoicing/

The United Kingdom

Although e-invoicing is not mandatory for B2G and B2B transactions in the UK, it is, however, used in the public healthcare system, as recommended by the tax authority.

Elsewhere in the world

Many Asian countries like Singapore have adopted PEPPOL for their e-invoicing mandates. In fact, countries like Austria, New Zealand, and so on, have also adopted PEPPOL to accelerate electronic invoicing.

Overall, bear in mind that electronic invoicing and reporting varies from country to country. Not just that, it also varies in terms of legal requirements and the types of transactions involved. As a matter of fact, there is no standard e-invoicing model or global electronic invoice document that everyone can follow, but several ones. The models use different technologies, infrastructure, formats, and methods for transferring documents. However, they all share a common objective – reducing VAT fraud and increasing tax income.

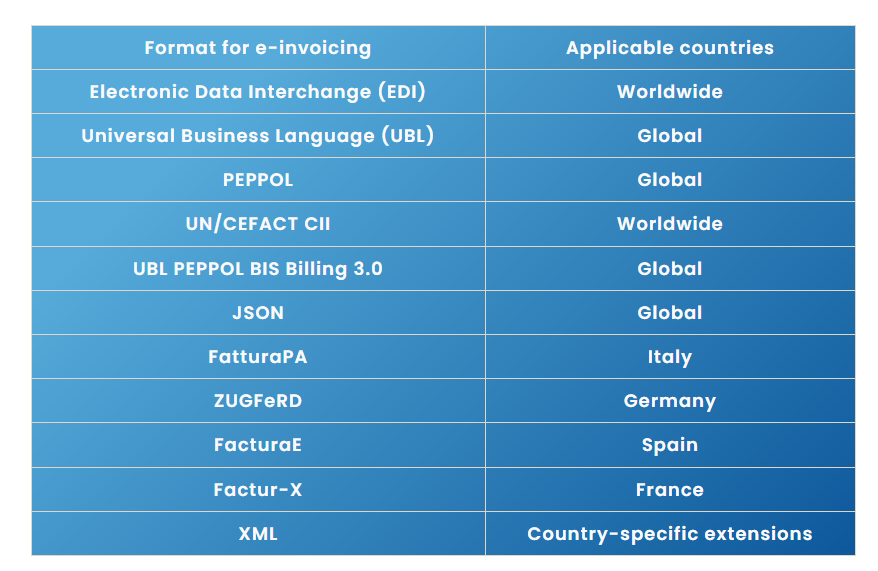

Formats of e-invoicing and e-reporting to know of

As mentioned above, e-invoicing and e-reporting models use different formats for the transfer of documents to the tax authorities. Here are some of the key formats that you must know about –

Electronic Data Interchange (EDI)

It is an older but a widely used electronic invoicing format. It involves structured data exchange between computer systems in a standardised format. There are several EDI standards that exists to aid the process, including EDIFACT and ANSI X12, used in different regions.

Pan-European Public Procurement Online (PEPPOL)

The PEPPOL network is a framework facilitating electronic procurement processes in Europe that includes specifications for e-invoices. In fact, public sector organisations and their suppliers use the PEPPOL network for cross-border electronic invoicing within Europe.

Universal Business Language (UBL)

This format is an XML-based standard for e-invoice, which is most commonly preferred across the world. As the name suggests, UBL is designed to be a universal format for electronic business documents like invoices and so on. Moreover, the Universal Business Language format is recognised by many governments and organisations for the interoperability and adaptability it offers.

FatturaPA

Italy, along with being the first European country to mandate e-invoicing and e-reporting, also has its own e-invoicing format – the FatturaPA. It is a format mandated for business-to-government (B2G) and business-to-business (B2B) transactions. Although it is based on the UBL standard, there are specific requirements for Italian taxation.

Goods and Service Tax Network (GSTN)

The GSTN is a specific e-invoicing format used in India under the GST regime. E-invoices in India are standardised in terms of data elements; they are generated in the JSON format.

ZUGFeRD

The Central User Guide of the Forum for Electronic Invoicing in Germany or ZUGFeRD is an e-invoicing standard, combining a PDF file with an XML file. These files contain structured invoice data, which makes e-invoicing and e-reporting more accessible with both human-readable and machine-readable formats.

Facturae

Facturae is an electronic invoicing format used in Spain depending on the requirements of the invoicing mandate. This Spanish e-invoicing format is based on the UBL standard and used for both B2B and B2G transactions.

Factur-X

An e-invoicing format primarily used in France, Factur-X combines both human-readable PDFs and structured XML invoices.

UN/CEFACT Cross-Industry Invoice (CII)

The CII is a global format for electronic invoicing, which is supported by the United Nations. In fact, CII is one of the most widely used formats in Europe and other regions.

UBL PEPPOL BIS Billing 3.0

This electronic invoicing format is an extension of the UBL standard, which is commonly used within the PEPPOL network. The format is mainly used for cross-border e-invoicing in Europe.

XML with country-specific extensions

Several countries have adopted XML-based formats with country-specific extensions to meet their legal and tax requirements. Such XML-based extensions often include additional data fields for filling in tax details and other regulatory information.

Implementing e-invoicing and e-reporting into your business

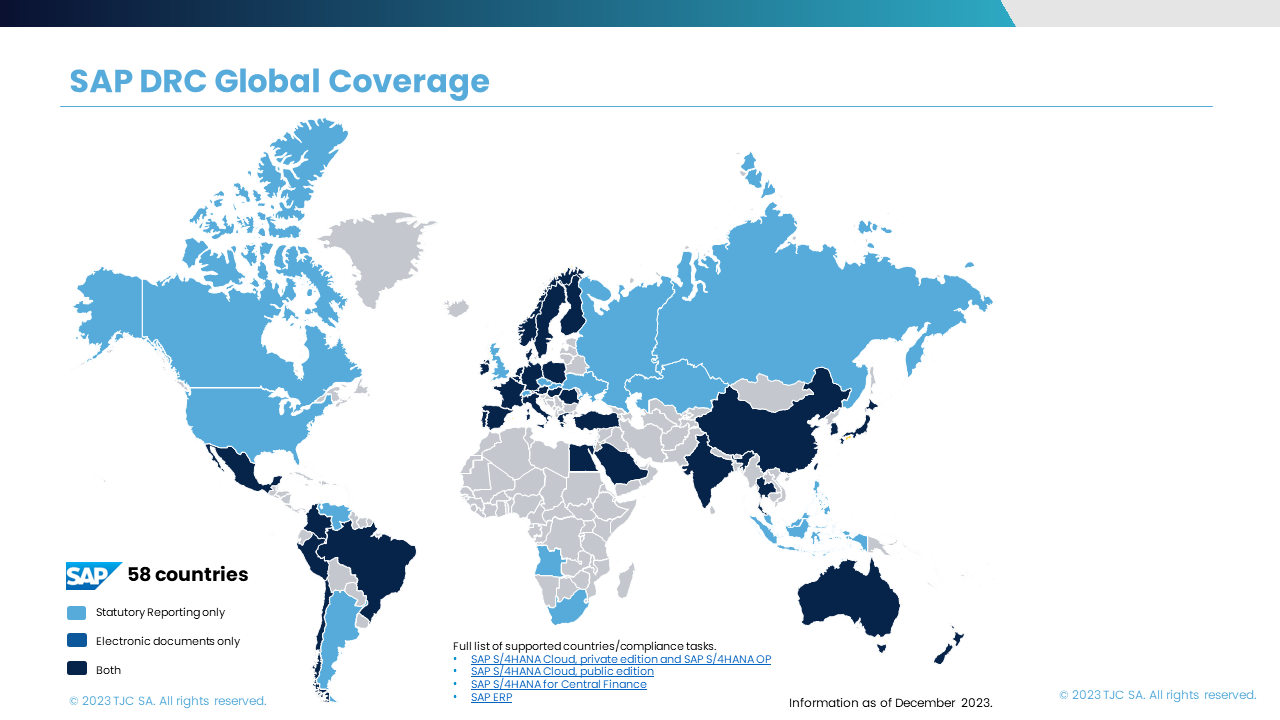

While implementing the electronic invoicing and reporting solution, wouldn’t it be amazing to have a helping hand to make the process smoother? Well, we know it would be significantly helpful! That’s why TJC Group is here to offer you the right solution – the SAP Document and Reporting Compliance or SAP DRC.

Here’s how we help you implement the solution with the help of SAP Activate methodology –

- Using the proven SAP Activate methodology, we help plan and execute the project and deliver optimised templates and accelerators.

- Our team of experts performs an initial project scoping important to identify possibilities and alleviate risks for project implementation and business impact.

- We define the best scope of practice, develop an initial scope statement and a fit/gap analysis and curate a project schedule for implementing SAP DRC.

- TJC Group goes the extra mile with its talented and senior SAP finance consultants, who work as an extension of your team.

We come with an experience of 25+ years, assisting our customers with challenges in SAP data management for tax and audit purposes. We understand the legal requirements for tax and audit, the business needs, and the technical aspects of compliance, putting forth our best efforts to ensure a smooth and successful partnership.

Contact us today to implement e-invoicing and e-reporting with SAP DRC!