With COVID-19 hitting the world, there has been a significant shift in the tax compliance landscape. While the short-term impact of the pandemic will gradually fade, moving towards e-invoicing and implementing digital tax reforms is what governments must do. Here’s an article that will help you understand the tax compliance landscape across the world.

The impact of COVID-19 in finances

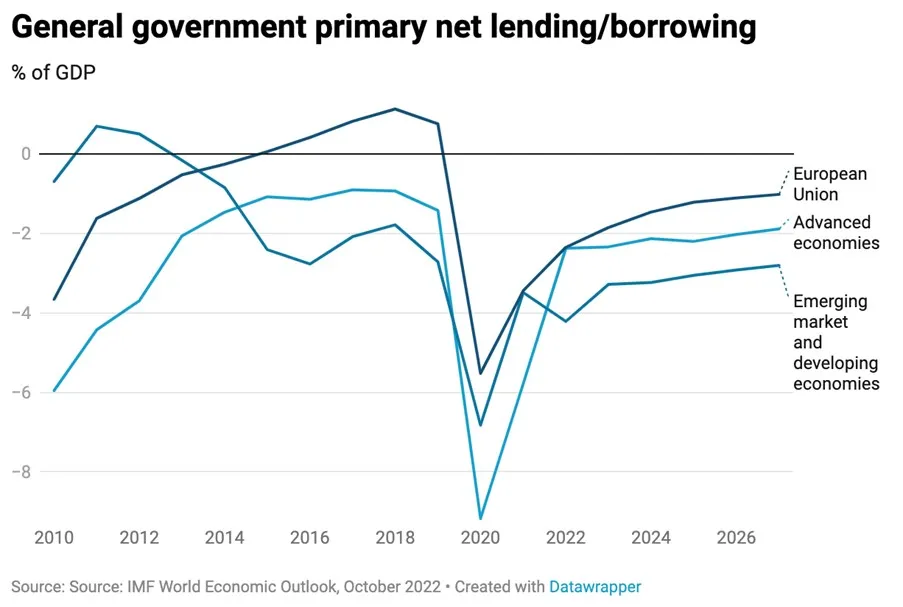

Government finances deteriorated extensively from 2020-2022 due to the Covid-19 pandemic. Not only did the pandemic significantly increase spending requirements in most countries (e.g., healthcare and business or consumer subsidies), but lockdowns constrained economic activity and thus depressed tax revenues. The Organisation for Economic Co-operation and Development (OECD) estimated that the pandemic has led to an average increase of 7 percentage points in the debt-to-GDP ratio for OECD countries. From a global perspective, the International Monetary Fund (IMF) estimated that global government debt reached a record high of 98% of global GDP in 2020, up from 84% in 2019.

While the short-term effect of the Covid-19 pandemic on government finances will fade in the coming years, several more structural factors will prevent a sustained recovery. These include demographic, climate change, energy security, and technology-driven disruption that will collectively increase calls on state spending while reducing taxable income.

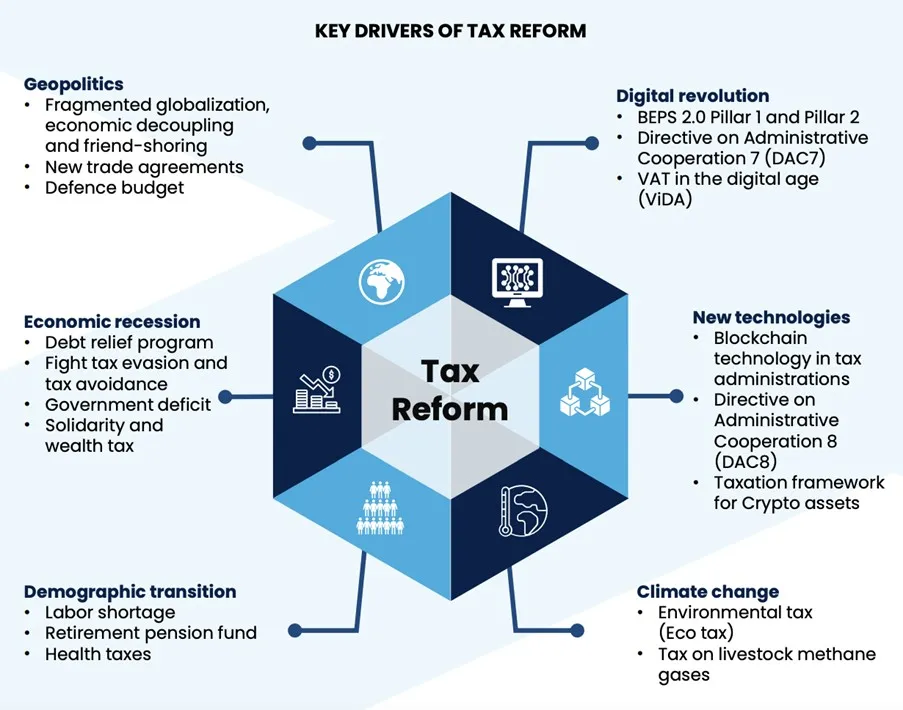

Key drivers of tax reform

The factors are summarised in the below infographic:

Demographic transition

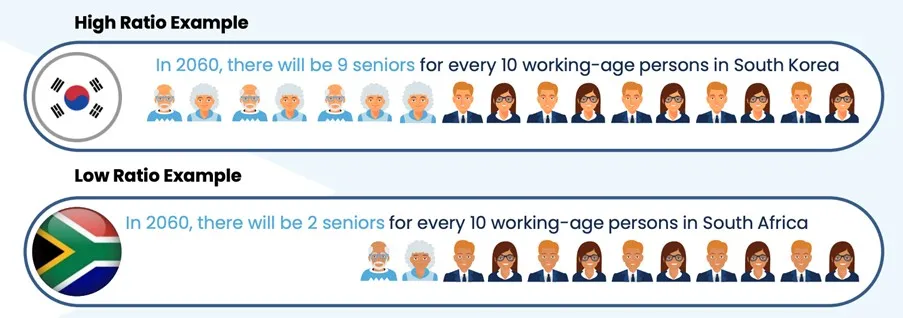

One of the structural factors placing pressure on government finances is the ageing of the global workforce. This demographic transition will be particularly pronounced in developed economies such as Japan and the EU, although also essential for some major emerging economies such as China.

- Oldest populations - Japan, Finland, and Italy

- Fastest ageing (OECD) - Greece, South Korea, Poland, Portugal, Slovakia, Slovenia, and Spain

- Fastest ageing (non-OECD) - Despite having younger populations, Brazil, China, and Saudi Arabia are ageing faster than the OECD average

Progress in global health and development has led to declining fertility and mortality rates and rapid ageing of the population. As a result, the number of older people will continue to rise in almost all countries worldwide in the coming years. According to the OECD, there will be 10 billion people on Earth by 2050, and many will live longer. As a result, the number of older adults per 100 working-age people will nearly triple – from 20 in 1980 to 58 in 2060.

Digital disruption to tax collection

The digital revolution brings opportunities and the development of new technologies, but it also raises several challenges in handling new transactions and taxation of the digital economy.

Recently, 137 country members of the OECD/G20 Inclusive Framework reached an agreement on Base Erosion and Profit Shifting (BEPS 2.0) to reform the international tax framework in response to the challenges relating to the taxation of the digital economy. The framework agreed to set a 15% global minimum corporate tax rate and mandate the automatic exchange of information (AEOI) across tax administrations to report on foreign nationals’ bank accounts and financial assets.

Elsewhere, the European Commission has proposed to amend the Directive on Administrative, DAC7, to extend the EU tax transparency rules to digital platforms. Member states will automatically exchange information on income sellers generated on digital portals. The DAC8 proposal will contain requirements for reporting and exchanging information on crypto assets for direct tax purposes.

Requisites for new sources of tax revenue

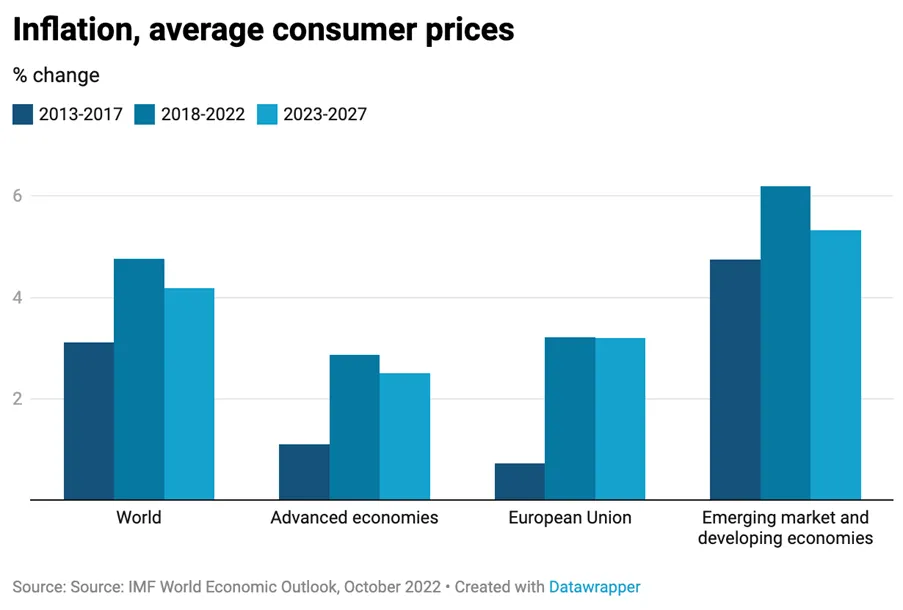

Government finances are expected to remain stretched over the coming years. The International Monetary Fund (IMF) forecasts the net borrowing requirements of the governments to average 2.1% of GDP over 2023-2027, compared to 1.3% in the five years preceding the 2020 global Covid-19 pandemic. In addition, the IMF forecasts the net borrowing requirements in emerging and developing markets to average 3.0% of GDP over 2023-2027, compared to 1.7% pre-pandemic. From 2008-2020, governments were generally content to use large fiscal deficits to fund mismatches between tax receipts and spending. A low-interest and low-inflation environment enabled this strategy over the period.

However, the surge in global inflation and interest rates since 2020 has made the prolonged running of large fiscal deficits more challenging for most governments; for developed economies such as the UK, US, and EU, government borrowing costs rose to the highest in 30 years in 2022. For emerging economies, the IMF estimates that the proportion of countries in debt distress or at high risk of debt distress may increase to 60% in 2021 from 30% in 2015.

To realign tax receipts and spending, governments must implement a combination of tax increases and spending cuts. To meet this challenge to fiscal sustainability, progressive and fair taxation policy is vital to sustaining tax compliance and trust in authorities. Equitable tax policy contributes to fairness, balancing the financial, social, human, environmental, and intergenerational impacts.

The digitalisation of tax compliance will boost revenues!

One of the strategies governments are employing to boost tax revenues is shifting tax compliance online. While this approach requires significant investment in new digital infrastructure and implementation, it has the potential to facilitate enforcement and increase tax compliance. Governments aim to increase tax revenues by improving compliance rates without undertaking the less politically palatable route of raising headline tax rates.

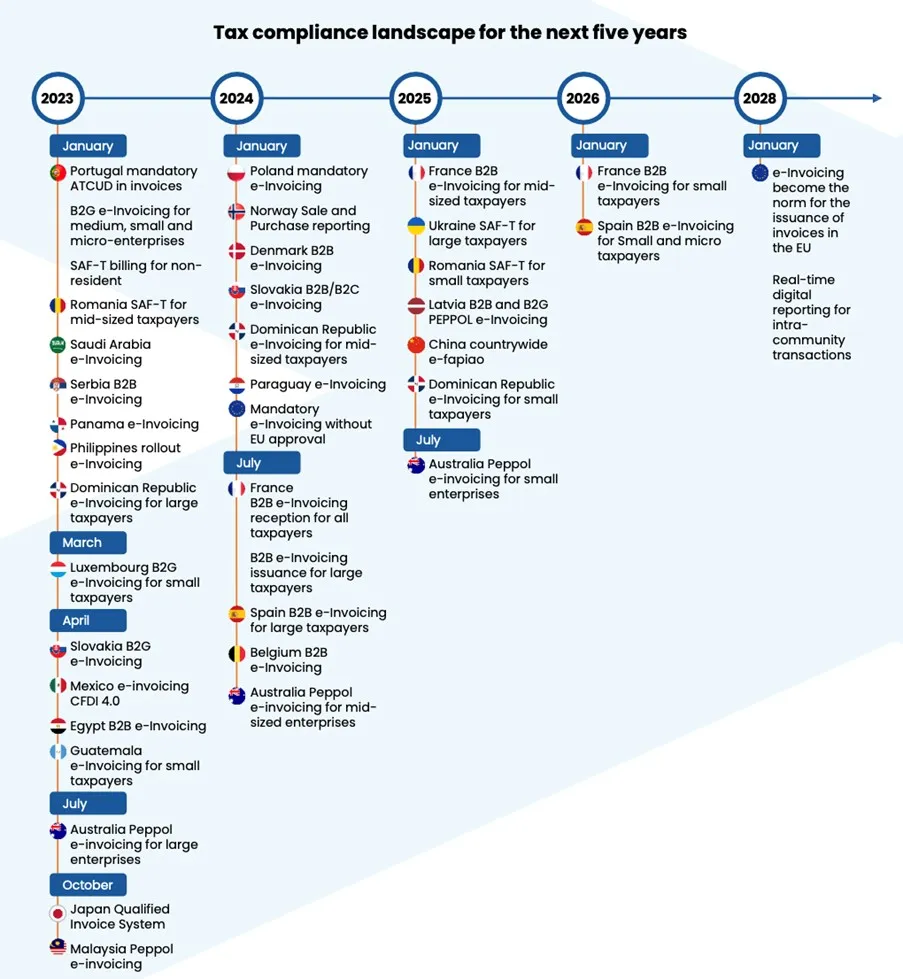

A paradigm shift is thus occurring in tax compliance, moving towards e-invoicing and e-reporting. The diagram below depicts changes over the next five years. The ultimate goal of new obligations introduced is to tackle tax evasion and tax avoidance, which impedes the efficiency and equity of tax systems.

Country-wise overview of the tax compliance landscape

The following diagram summarises some of the main reforms to tax compliance being implemented worldwide over 2023-2028. The subsequent sections then provide more detail on impending changes to tax compliance country by country.

Belgium

Belgium plans to introduce mandatory Business-to-Business (B2B) e-invoicing for domestic transactions, which leverages PEPPOL and will extend the initiative to include an e-reporting obligation based on the European Commission’s ViDA (VAT in the Digital Age) package. That said, B2B e-invoicing is expected to apply from 1st July 2024, while the government is yet to announce the official date for the e-reporting obligations.

Denmark

Denmark passed a new bookkeeping law introducing requirements for companies to use a digital bookkeeping system and aim to implement B2B e-invoicing with the following timeline –

- January 2023: The tax authority will provide digital bookkeeping systems requirements.

- July 2023: Suppliers must adapt their digital bookkeeping systems to new requirements to certify their solution.

- January 2024: Addresses large companies.

- January 2026: Addresses all taxpayers.

France

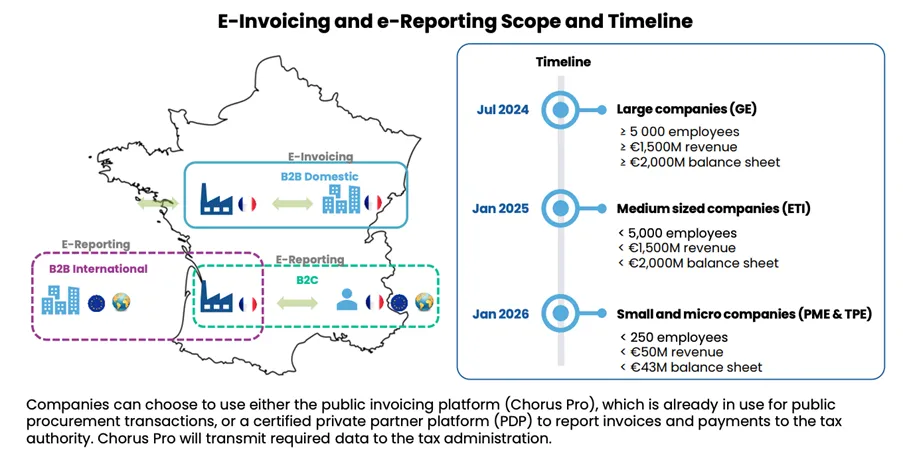

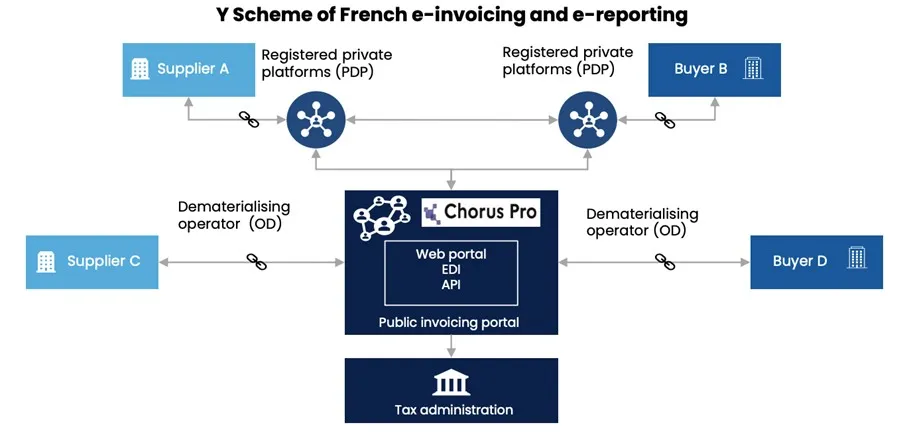

The French tax administration will mandate electronic invoicing and e-reporting from 1st July 2024 to 2026, depending on the company’s size. The requirement to receive electronic invoices will apply to all companies from 1st July 2024.

Germany

The federal ministry of finance is seeking approval from the European Commission to mandate countrywide B2B e-invoicing, preparing to align with the VAT in the Digital Age (ViDA) package.

Greece

VAT returns are now pre-filled using data collected through the MyDATA system from 5th December 2022, concerning the tax period from 1st January 2022 onwards. The objective is to simplify the filing process for VAT returns. Taxpayers can modify records to ensure the accurate submission of VAT returns.

Latvia

The Latvian government approved the introduction of mandatory B2B and B2G e-invoicing in 2025. The exchange of electronic invoices will follow the European e-invoicing standard EN16931 and adopt the PEPPOL network as a single standard for sending and receiving e-invoices.

Lithuania

The Lithuanian government launched a tender for developing an e-invoicing solution. Expected to introduce an e-invoicing system by September 2023, the exchange platform will support the European e-invoicing standard EN16931 and comply with the PEPPOL network.

Luxembourg

B2G e-invoicing will gradually become mandatory between 2022 and 2023. Companies affected by the regulations must submit and process electronic invoices using a PEPPOL network. The timeline varies depending on the size of the companies:

- 18th May 2022 – Large companies

- 18th October 2022 – Medium-sized companies

- 18th March 2023 – Small companies

Poland

The Polish national e-invoicing system (Krajowy System e-Faktur: KSeF) is a centralised clearance platform for issuing, receiving, and archiving B2B e-invoices. It is now available for voluntary use but will become mandatory from 1st January 2024. Required data in the structured e-invoice, FA_VAT, is similar to SAF-T JPK_FA sales invoice files, with some additional information from JPK_V7M/K VAT register and declaration files, such as document type, sensitive goods/services group (GTU code), and supply procedures. In addition, supplementary information such as payment data, data related to the settlement of customs duties, transaction terms, and warehouse details are required.

Portugal

ATCUD is mandatory from January 2023

Portuguese Tax Authorities introduced ATCUD as a unique document code, making it obligatory from January 2023. Companies must communicate their document series through web service or manually on the portal and obtain a validation code required to generate the ATCUD. The ATCUD links the validation code returned by Tax Authorities for each series communicated, plus the internal document number. The ATCUD must be included in the QR code, printed documents, electronic invoices, and reporting via SAF-T. Action required by affected firms include –

- Communication of document series with the tax authorities automatically with web services.

- Processing it manually in the portal and obtaining the validation code.

- Adapting print layouts to include the ATCUD in the forms of all digitally signed documents.

- Updating ATCUD in the QR code.

- Reporting the ATCUD in SAF-T and e-invoices.

SAF-T billing obligation extended to non-established businesses with shortened deadlines

From 1st January 2023, the Portuguese tax authority (AT) extended the duty to report SAF-T billing files to non-established VAT-registered companies in Portugal. That said, the submission deadline is refined from the 12th day of the following month to the 5th day of the month. However, the new directive comes with a grace period, where no penalties will be applied if organisations report before the 8th day of the following month.

B2G e-invoicing for medium, small, and micro-enterprises

The mandatory B2G invoicing in the CIUSPT format started on 1st January 2023 for medium, small, and micro-enterprises.

IES pre-filled by SAF-T accounting file postponed

The obligation to submit the SAF-T Accounting file to tax authorities applies only for purposes of pre-populating the Annual Accounting and Tax Information return (IES/DA) for the 2023 fiscal period (and subsequent periods), that organisations must submit from 2024 onwards.

Romania

B2B e-invoicing

Following the first phase of mandated B2B e-invoicing for high-risk fraud products from July 2022, Romania is now preparing to implement mandatory B2B e-invoicing for all companies through its national platform from 2024.

SAF-T

SAF-T Romania has been mandatory for large taxpayers since January 2023. The regulation will extend to medium-sized taxpayers in January 2024 and small taxpayers in January 2025. SAF-T Romania consists of the following:

Monthly filing

- General Ledger entries, Accounts Receivable, Accounts Payable, and relevant master data.

- The submission deadline is the last calendar day of the month following the reporting period.

Annual filing

- Fixed assets

- The submission deadline is the same as the deadline for the financial statement of the year.

On-demand filing

- Goods movement

- The submission deadline is within the term established by the tax administration, which may be at least 30 calendar days from the requested date.

Slovakia

The Slovakian authorities delayed the plan to implement B2G e-invoicing from January 2023 to April 2023. IS EFA (Informačný Systém Elektronickej Fakturácie) is available for testing purposes for B2B and B2C e-invoicing of domestic transactions in 2023 voluntarily; however, it will become mandatory in 2024.

Spain

Spain plans to implement B2B e-invoicing on top of SII from 2024 for large taxpayers with a turnover of €8+ million and by 2026 for all other taxpayers. Invoices generated by VERI*FACTU-certified invoicing systems must include a QR code. The narrative of invoice verifiable at the electronic headquarters of the AEAT, or VERI*FACTU, is where the system sends the invoicing records directly to the AEAT via web services. The law introducing mandatory B2B e-invoicing in Spain has been officially published.

SII – New changes for special schemas (travel agencies and used goods, arts, and antiques)

The Spanish Tax Agency (AEAT) has published the following changes in SII, which became effective on 1st January 2023 –

- A technical modification is included in the Registry Books of Issue. This modification of the RIVA (article 63) intends to enable the registration of changes in the tax base and tax amount for which there is no obligation to issue a correction invoice, such as tax amount adjustments derived from the margin tax base.

- In case of transactions covered by the Travel Agencies VAT Schema (REAV) or by the Used Goods, Art objects, Antiques and Collectibles VAT Schema (REBU) when the issuance of a correction invoice is not appropriate, the regularisations or adjustments of the tax base and tax amount initially calculated will be recorded in the Book of Issued Invoices as a result of discounts or other circumstances after the accrual of the operation.

- Such invoices will be registered under a new invoice type AJ (ajuste del margen de beneficio/Profit Margin adjustment). REAV-issued invoices shall inform the tax base and the tax amount.

Sweden

The Swedish authorities are evaluating digital reporting models like VAT listings, SAF-T, real-time invoice reporting, mandated electronic invoicing, etc. In addition, they are likely to move forward with mandatory e-invoicing with PEPPOL.

Ukraine

The Ukrainian Ministry of Finance has adopted Standard Audit File for Tax (SAF-T) since 2021. The scope of SAF-T in Ukraine is as follows:

- General ledger accounting entries

- Sales ledger

- Cash receipts

- Fixed asset register

- Intangible asset movements

- Tax reconciliation

Looking ahead, SAF-T UA will have a phased introduction from 2023 to 2027 as follows:

- 1st January 2023 – On-demand for large taxpayers

- 1st January 2025 – Periodic submissions for large taxpayers

- 1st January 2027 – Periodic submissions for all taxpayers.

Key takeaways

- To realign tax receipts and spending, governments must implement a combination of tax increases and spending cuts.

- One of the strategies governments are employing to boost tax revenues is shifting tax compliance online.

- A paradigm shift is thus occurring in tax compliance, moving towards e-invoicing and e-reporting.

- It can be concluded that many countries will implement digital tax reforms in the coming years, as outlined in detail in this article.

If you are looking for more information on SAP tax compliance or need help with e-invoicing, TJC Group is here to help. Contact us today!